N&V Law Group is a dedicated law agency specializing in combating online scams and frauds, particularly in forex trading, cryptocurrency, and fake recovery schemes.

This case study outlines the journey of one of our clients, from the moment he sought our help to the successful recovery of his lost investments.

Our client’s journey began when he reached out to us through our virtual presence website. The client, who we will refer to as Mr. A for confidentiality, had fallen victim to an elaborate forex trading scam. He applied to our office, and we promptly arranged an interview to gather all the necessary information to start his case.

During the interview, we collected comprehensive details about Ms. A’s identity and her experiences with the fraudulent company. This included documented evidence such as emails, transaction records, and communication logs, as well as undocumented experiences and personal accounts of the scam. The primary objective of this step was to create a clear picture of the fraud and establish a solid foundation for our investigation.

Ms. A initially invested a sum of €78,574.32 with a company that portrayed itself as expert forex traders. Over time, the scammers convinced Ms. A to invest gradually, promising that her investment would triple within three months. Trusting these promises, Ms. A continued to invest more of her savings. Unbeknownst to her, some of her investments were indeed placed with real forex brokers, and her capital grew to €178,265.02.

However, as soon as the scammers saw an opportunity, they seized the entire capital and disappeared without a trace, leaving Ms. A in a state of distress and financial ruin.

This is a known scheme where scammers initially gain the victim’s trust by investing their money with legitimate brokers. As the investments grow and the victim gains confidence, the scammers seize the entire capital. They transfer the funds to their wallets and vanish, making it extremely difficult for victims to trace or recover their money. This method allows scammers to exploit both the victim’s trust and the legitimate financial system to maximize their illicit gains.

Once we had all the necessary data, we commenced our investigation. Online investigations are fraught with challenges, but thanks to our exclusive partnerships with various companies and entities, we were able to make significant progress.

Our first step was utilizing our proprietary AI software, specifically designed for tracking financial transactions and identifying patterns indicative of fraudulent activity. This advanced software enabled us to meticulously analyze the transaction data provided by Ms. A, tracing the flow of her funds through various accounts and intermediaries. The AI’s capability to process vast amounts of data quickly and accurately provided us with a detailed map of the transactions.

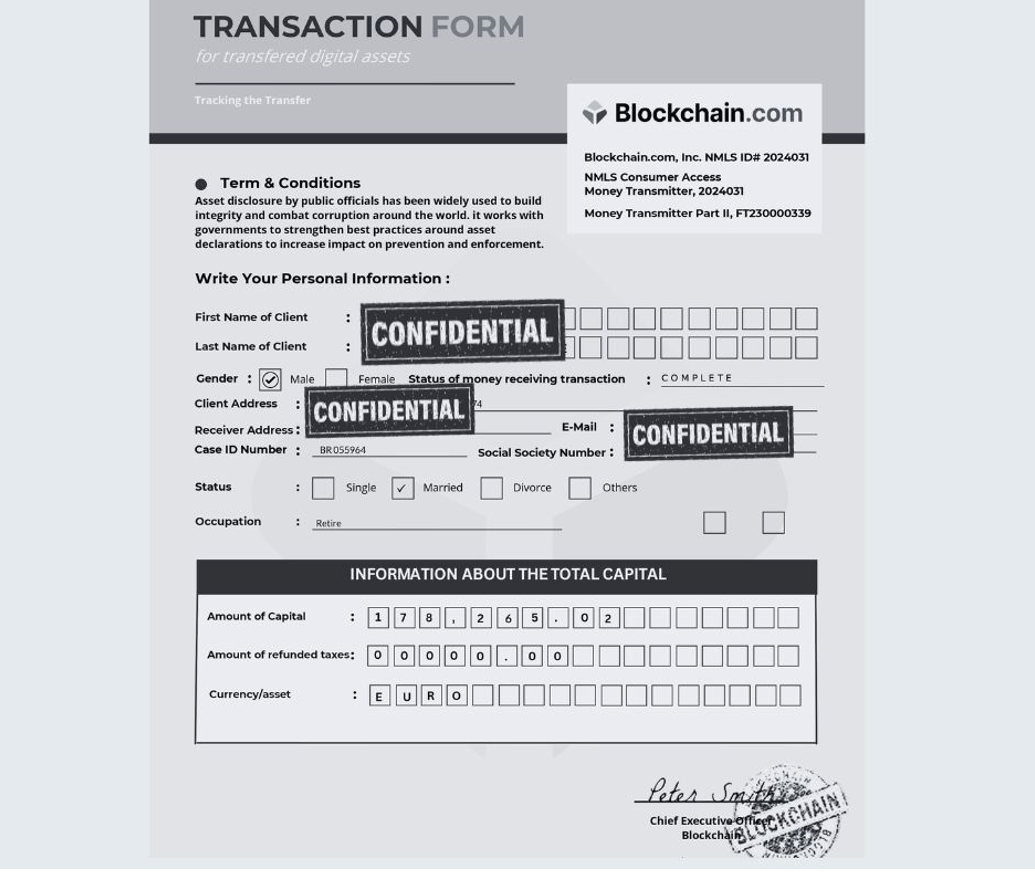

Blockchain was our next point of contact.

Blockchain is a decentralized ledger technology that records transactions across multiple computers. It ensures the integrity and security of data, making it a vital tool in tracking fraudulent financial activities. Blockchain allows for the transparent and immutable recording of transactions, which can be crucial in tracing the flow of stolen funds.

We provided Blockchain with all the information Ms. A had given us, including her identity documents, wallet details, and wire transfer records. With this data, Blockchain was able to track the funds and determine where they had been transferred. Within a few days, we received a detailed report outlining the exact amount Ms. A had lost and the destinations of the funds.

The information from Blockchain was crucial for the next phase of our investigation. We reached out to the Serious Fraud Office (SFO). SFO is a UK government agency responsible for investigating and prosecuting serious or complex fraud, bribery, and corruption. Their mission is to protect society by pursuing justice against those who commit financial crimes and recovering assets for victims. With the expertise of SFO, we delved deeper into the investigation. They helped us uncover the identity of the scammer, a breakthrough that was essential for proceeding with legal actions. The SFO's assistance was invaluable, providing us with the authority and resources needed to confront the perpetrators. Once the scammer's identity was revealed, we forwarded this information to the relevant authorities. However, our mission was not just to identify the fraudsters but to recover the lost capital and return it to Ms. A.

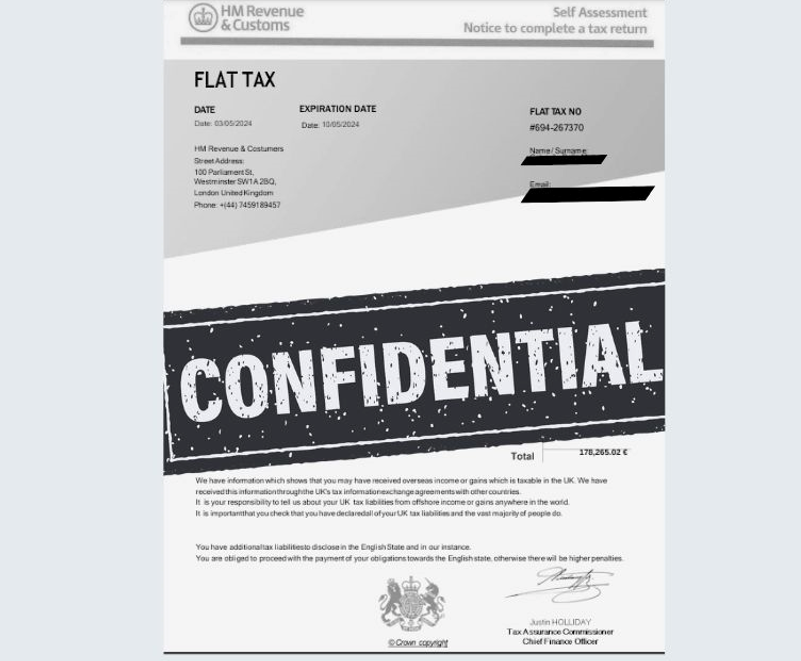

The next step involved contacting HM Revenue & Customs (HMRC). HM Revenue & Customs is a UK government department responsible for the collection of taxes, the payment of some forms of state support, and the administration of other regulatory regimes, including anti-money laundering measures. HMRC plays a crucial role in combating financial crimes and ensuring that illegally obtained funds are seized and properly processed. The funds tracked by Blockchain and confirmed by the SFO were found in several wallet addresses. To proceed with the recovery, the funds needed to be cleared by a state entity. HMRC facilitated this process, ensuring that the seized funds were legally processed and prepared for transfer back to Ms. A.

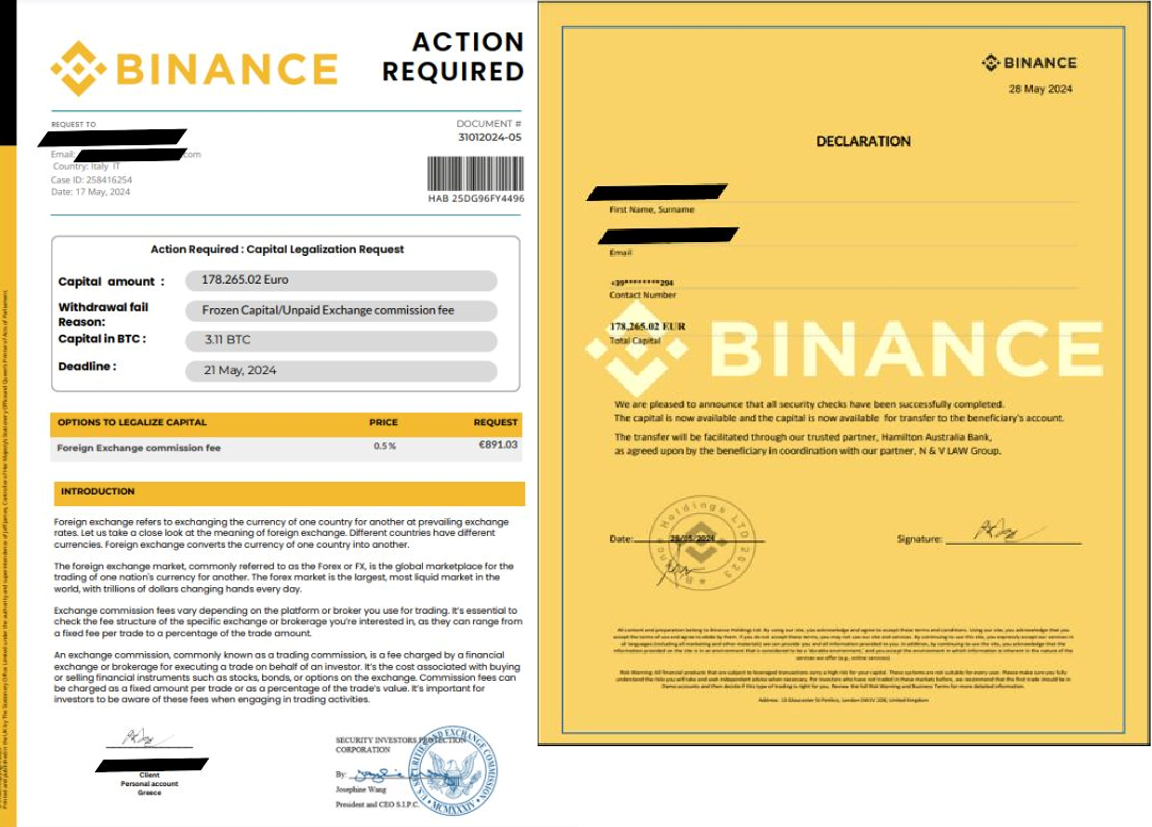

After HMRC's clearance, the next step involved ensuring the secure transfer of funds. Given the history of the money and the associated scams, it was essential to handle the withdrawal and transfer with utmost security. For this purpose, we collaborated with Binance, our trusted partner. Binance is one of the world's leading cryptocurrency exchanges. It provides a platform for trading various cryptocurrencies and is renowned for its robust security measures and compliance with regulatory standards. Binance's expertise in handling cryptocurrency transactions made them an ideal partner for this operation. Binance played a crucial role in unfreezing the funds after HMRC cleared them. However, due to the nature of the transactions and the history of the funds, Binance would not allow these funds to be withdrawn through online wallets. Instead, for security reasons, the funds needed to be transferred through a partnered property entity.

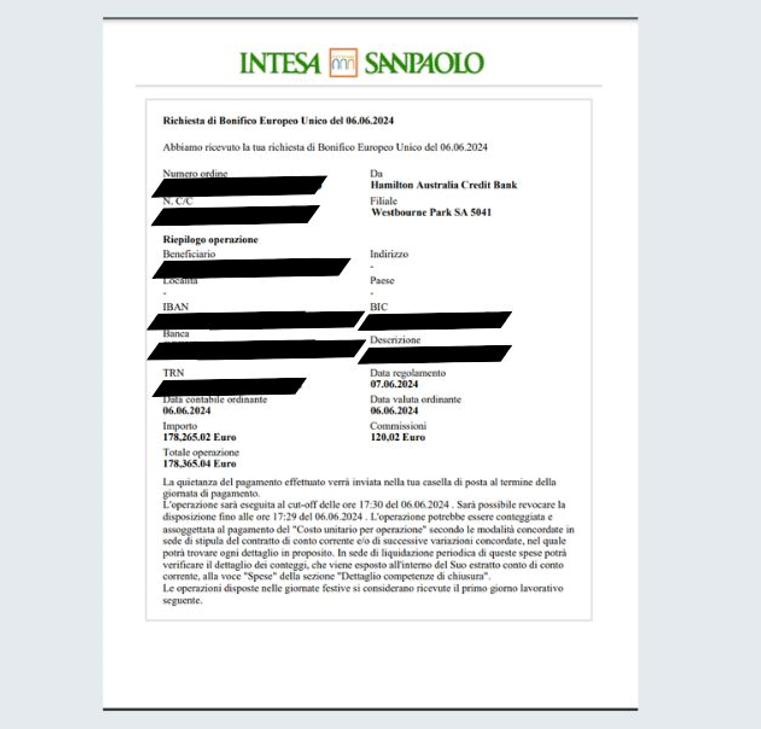

Hamilton Australia Credit Bank was identified as the best option for this process. This bank, partnered with Binance, HMRC, and N&V Law Group, specializes in handling funds with complex histories and ensures their secure transfer across international borders. Hamilton Australia Credit Bank facilitated the process of unfreezing the capital and making it available for withdrawal. This secure process ensured that the funds were cleared for legal transfer and that the entire operation was transparent and compliant with international financial regulations. Additionally, N&V Law Group's service fee was paid through this bank, as shown in the accompanying document. It is important to note that the service fees are subject to change depending on the specifics of each case; for this particular case, the fees were outlined in the documentation. Fees for other cases may be less or more, depending on their complexity and requirements.

Hamilton Australia Credit Bank was identified as the best option for this process. This bank, partnered with Binance, HMRC, and N&V Law Group, specializes in handling funds with complex histories and ensures their secure transfer across international borders. Hamilton Australia Credit Bank facilitated the process of unfreezing the capital and making it available for withdrawal. This secure process ensured that the funds were cleared for legal transfer and that the entire operation was transparent and compliant with international financial regulations. Additionally, N&V Law Group's service fee was paid through this bank, as shown in the accompanying document. It is important to note that the service fees are subject to change depending on the specifics of each case; for this particular case, the fees were outlined in the documentation. Fees for other cases may be less or more, depending on their complexity and requirements.

Through a meticulous and collaborative effort involving our proprietary AI software, Blockchain, SFO, HMRC, Binance, and Hamilton Australia Credit Bank, we were able to successfully recover €178,265.02 for Ms. A. This case highlights the importance of a comprehensive and systematic approach in tackling online scams and frauds.

At N&V Law Group, we are committed to providing our clients with the best possible support and expertise in their fight against online fraud. Our partnerships with leading entities in the field, combined with our dedication to justice, enable us to achieve remarkable results for our clients.

Through a meticulous and collaborative effort involving our proprietary AI software, Blockchain, SFO, HMRC, Binance, and Hamilton Australia Credit Bank, we were able to successfully recover €178,265.02 for Ms. A. This case highlights the importance of a comprehensive and systematic approach in tackling online scams and frauds.

At N&V Law Group, we are committed to providing our clients with the best possible support and expertise in their fight against online fraud. Our partnerships with leading entities in the field, combined with our dedication to justice, enable us to achieve remarkable results for our clients.